About Horizon Value Calculator (Formula)

The Horizon Value Calculator is an essential tool in finance, particularly in the realm of investment analysis. It helps investors determine the future value of an investment at the end of a specific period, factoring in expected cash flows and growth rates. By calculating the horizon value, investors can make informed decisions about the worth of their investments over time. This article will discuss the formula used in this calculation, provide step-by-step instructions on how to use the calculator, illustrate an example, and answer frequently asked questions regarding horizon value.

Formula

The formula for calculating horizon value is:

HV = ACF / (RR – GR)

where HV represents the horizon value, ACF is the anticipated cash flow, RR is the required rate of return, and GR is the growth rate.

How to Use

To use the Horizon Value Calculator effectively, follow these steps:

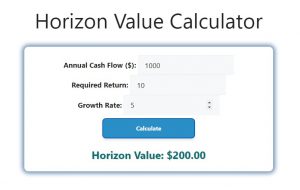

- Gather Data: Collect the necessary information, including the anticipated cash flow (ACF), required rate of return (RR), and growth rate (GR).

- Input Values: Enter the values for ACF, RR, and GR into the calculator.

- Calculate Horizon Value: Click the calculate button. The calculator will process the input and provide the horizon value (HV) as a result.

Example

Let’s consider an example where the anticipated cash flow (ACF) is $1,000, the required rate of return (RR) is 10% (0.10), and the growth rate (GR) is 5% (0.05). To calculate the horizon value:

- Use the formula:

HV = ACF / (RR – GR)

HV = 1000 / (0.10 – 0.05)

HV = 1000 / 0.05

HV = $20,000.

Thus, the horizon value is $20,000.

FAQs

- What is horizon value?

Horizon value represents the estimated value of an investment at the end of a specific period, considering future cash flows and growth rates. - Why is horizon value important?

It helps investors assess the long-term value of their investments and make informed decisions regarding their portfolios. - What does ACF stand for?

ACF stands for anticipated cash flow, which is the expected income generated from the investment. - What is meant by required rate of return (RR)?

The required rate of return is the minimum return an investor expects to earn on an investment. - What does growth rate (GR) signify?

The growth rate indicates how much the cash flows are expected to increase over a specific period. - Can horizon value be negative?

No, horizon value cannot be negative. If cash flows do not exceed the required rate of return, the investment may not be viable. - How often should I recalculate horizon value?

It is advisable to recalculate horizon value periodically or whenever significant changes occur in cash flows, rates, or growth expectations. - Is horizon value used in all types of investments?

While commonly used in equity and real estate investments, horizon value can be applied to any investment with predictable cash flows. - What factors influence the required rate of return?

Factors include market conditions, investment risk, and opportunity costs associated with alternative investments. - How does the growth rate affect horizon value?

A higher growth rate increases the horizon value, while a lower growth rate decreases it, assuming cash flows remain constant. - Is there a limit to how far into the future I can calculate horizon value?

There is no strict limit, but estimates become less reliable as the time frame increases due to uncertainties. - Can I use this calculator for personal finance?

Yes, it can be used for personal investment decisions, such as evaluating retirement savings or other long-term financial goals. - What should I do if my cash flows fluctuate significantly?

In cases of fluctuating cash flows, consider using a conservative estimate or calculating multiple scenarios to assess potential outcomes. - Are there other methods to evaluate investments besides horizon value?

Yes, methods such as net present value (NPV), internal rate of return (IRR), and payback period are also used in investment analysis. - What role does inflation play in horizon value calculations?

Inflation can affect both cash flow projections and the required rate of return, so it’s important to factor it into your calculations. - Can I use the horizon value in business valuations?

Yes, it is often used in business valuations to estimate the terminal value in discounted cash flow (DCF) analyses. - What is the difference between horizon value and terminal value?

Horizon value is specifically related to cash flows expected at the end of a period, while terminal value is a broader concept used in DCF analysis to estimate the value beyond the projection period. - Should I include taxes in my cash flow calculations?

Yes, it is important to consider taxes when estimating cash flows to obtain a more accurate representation of net income. - What are the limitations of the horizon value calculator?

The calculator relies on estimates and assumptions, which may not always hold true; thus, results should be viewed with caution. - How can I improve the accuracy of my calculations?

Regularly update your input data based on market conditions and company performance to enhance the accuracy of your horizon value assessments.

Conclusion

The Horizon Value Calculator is a valuable tool for investors and analysts looking to determine the long-term value of an investment based on expected cash flows and growth rates. By understanding the formula, learning how to use the calculator, and recognizing its importance in financial analysis, users can make informed decisions about their investment strategies. With this knowledge, you can better assess the potential return on your investments and optimize your financial planning.