About Assessment Ratio Calculator (Formula)

The Assessment Ratio Calculator is a valuable tool for property owners, real estate professionals, and tax assessors. It helps determine the assessment ratio of a property, which is essential for understanding how much of a property’s market value is subject to taxation. By accurately calculating the assessment ratio, stakeholders can ensure fair property taxation and proper valuation, leading to a more equitable system.

Formula

The formula for calculating the Assessment Ratio is:

ASR = AV / MV

Where:

- ASR is the Assessment Ratio.

- AV is the Assessed Value of the property.

- MV is the Market Value of the property.

How to Use

Using the Assessment Ratio Calculator is straightforward. Follow these steps:

- Determine the Assessed Value (AV): This is the value assigned to a property by the tax assessor for taxation purposes. You can find this value on your property tax statement or local assessor’s website.

- Determine the Market Value (MV): This is the price that a property would sell for in the current market. You can estimate this through real estate listings, property appraisals, or recent sales of similar properties in your area.

- Input Values: Enter the assessed value and market value into the calculator.

- Calculate ASR: The calculator will divide the assessed value by the market value to provide you with the assessment ratio.

Example

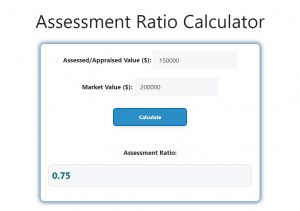

Let’s consider an example to illustrate how to use the Assessment Ratio Calculator:

- Assessed Value (AV): $150,000

- Market Value (MV): $200,000

Using the formula:

ASR = AV / MV

ASR = 150,000 / 200,000

ASR = 0.75

In this example, the Assessment Ratio is 0.75, meaning that 75% of the market value of the property is assessed for tax purposes.

FAQs

- What is an assessment ratio?

- The assessment ratio is the relationship between the assessed value of a property and its market value, expressed as a percentage or decimal.

- Why is the assessment ratio important?

- It helps determine how much of a property’s value is subject to taxation and ensures fairness in property taxation.

- How do I find the assessed value of my property?

- You can find the assessed value on your property tax statement or by contacting your local tax assessor’s office.

- What affects the market value of a property?

- Factors such as location, condition, size, and recent sales of similar properties can influence the market value.

- Can I use the assessment ratio to challenge my property taxes?

- Yes, if you believe your assessment ratio is too high compared to similar properties, you may have grounds to challenge your property taxes.

- How often is the assessed value updated?

- The assessed value is typically updated annually or biennially, depending on local regulations.

- What happens if the assessed value is lower than the market value?

- If the assessed value is lower, you may pay less in property taxes, but it could also affect your ability to sell the property at its market value.

- Can the assessment ratio vary by property type?

- Yes, different property types may have different assessment ratios based on local regulations and tax policies.

- How do I calculate the assessment ratio for commercial properties?

- The same formula applies: divide the assessed value by the market value, regardless of the property type.

- Is there a standard assessment ratio?

- Assessment ratios vary by jurisdiction and can differ based on property types and local tax policies.

- What should I do if I disagree with my property’s assessed value?

- Contact your local tax assessor’s office to discuss the assessment and potentially appeal the decision if warranted.

- How can I estimate my property’s market value?

- You can use online real estate platforms, hire a professional appraiser, or compare recent sales of similar properties.

- What is a fair assessment ratio?

- A fair assessment ratio is typically between 0.80 and 1.00, meaning the assessed value is 80-100% of the market value.

- Do property improvements affect the assessment ratio?

- Yes, improvements can increase the assessed value and potentially affect the assessment ratio.

- Can the assessment ratio change over time?

- Yes, changes in the market or property conditions can lead to adjustments in both assessed and market values, affecting the ratio.

- What are the consequences of an incorrect assessment ratio?

- An incorrect assessment ratio can lead to overpayment or underpayment of property taxes and may necessitate a reassessment.

- How do local laws affect assessment ratios?

- Local laws and regulations dictate how properties are assessed and taxed, leading to variations in assessment ratios across jurisdictions.

- Can I use the assessment ratio to compare properties?

- Yes, comparing assessment ratios can help you gauge how properties are valued relative to their market value.

- What tools are available for calculating assessment ratios?

- Online calculators, spreadsheets, or financial software can be used to calculate assessment ratios efficiently.

- Is the assessment ratio relevant for renters?

- While it primarily affects property owners, understanding assessment ratios can help renters gauge potential rent increases tied to property taxes.

Conclusion

The Assessment Ratio Calculator is a crucial tool for understanding property valuation and ensuring fair taxation. By using the formula ASR = AV / MV, property owners and real estate professionals can effectively evaluate assessment ratios, enabling informed decisions regarding property taxes and market value. With a clear understanding of this calculation, stakeholders can work towards ensuring that property assessments remain equitable and accurate, fostering a fairer tax system for all.