About Absorption Cost Calculator (Formula)

In the world of manufacturing and production, understanding costs is crucial for pricing strategies and profitability analysis. The Absorption Cost Calculator is a valuable tool that helps businesses calculate the total production costs by taking into account direct labor, material costs, and overhead expenses. This comprehensive approach provides a clearer picture of the cost per unit, enabling companies to make informed decisions regarding pricing, budgeting, and financial forecasting.

Formula

The formula for calculating absorption cost is:

Absorption Cost = (Direct Labor Costs + Material Cost + Overhead Costs) / Number of Units Produced

This formula combines all relevant costs associated with production to provide a per-unit cost, allowing businesses to assess their cost structure effectively.

How to Use

Using the Absorption Cost Calculator is straightforward:

- Gather Cost Data: Collect the necessary cost data, including direct labor costs, material costs, and overhead costs related to the production process.

- Determine the Number of Units Produced: Identify the total number of units produced during the given period.

- Apply the Formula: Insert the gathered data into the formula to calculate the absorption cost per unit.

- Analyze the Results: Use the calculated absorption cost to assess pricing strategies and profit margins.

Example

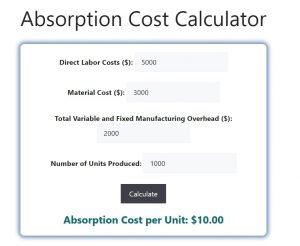

Suppose a company incurs the following costs for a production run:

- Direct Labor Costs: $5,000

- Material Cost: $3,000

- Overhead Costs: $2,000

- Number of Units Produced: 1,000

Using the formula:

Absorption Cost = ($5,000 + $3,000 + $2,000) / 1,000 = $10 per unit.

In this example, the absorption cost per unit is $10.

FAQs

- What is absorption costing?

Absorption costing is a method that captures all costs associated with manufacturing a particular product, including direct and indirect costs. - Why is absorption costing important?

It helps businesses determine the true cost of production, aiding in pricing decisions and financial reporting. - How does absorption costing differ from variable costing?

Absorption costing includes all manufacturing costs (fixed and variable), while variable costing only considers variable costs. - What costs are included in absorption costing?

It includes direct labor costs, material costs, and all overhead costs. - Can absorption costing impact financial statements?

Yes, it can affect inventory valuation and profit reporting, as different costing methods yield different results. - Is absorption costing mandatory for financial reporting?

Yes, generally accepted accounting principles (GAAP) require absorption costing for external financial reporting. - How does absorption costing affect pricing strategies?

By understanding the total production costs, businesses can set competitive prices while ensuring profitability. - What are overhead costs?

Overhead costs are indirect costs that cannot be directly attributed to a specific product, such as rent, utilities, and salaries of support staff. - Can absorption costs vary by product?

Yes, different products may have different direct labor and material costs, resulting in varying absorption costs. - How can businesses reduce absorption costs?

They can optimize production processes, negotiate better material prices, and manage overhead expenses effectively. - Is absorption costing suitable for all businesses?

It is commonly used in manufacturing but can be applied in any sector where product costs need to be accurately calculated. - What is a cost-volume-profit analysis?

It is an analysis that examines how changes in costs and volume affect a company’s operating income and net income. - How often should businesses calculate absorption costs?

It’s advisable to calculate absorption costs regularly, especially when launching new products or during financial planning. - Can seasonal variations affect absorption costing?

Yes, fluctuations in production levels during different seasons can impact the calculation of absorption costs. - What role does technology play in absorption costing?

Advanced accounting software can streamline data collection and calculations, improving accuracy and efficiency. - What is the impact of under- or over-absorption?

Under-absorption can lead to understated costs and profits, while over-absorption may inflate costs, affecting decision-making. - Are there limitations to absorption costing?

One limitation is that it may mask the actual profitability of products if not analyzed alongside variable costs. - How can companies optimize their absorption costs?

Companies can optimize costs through lean manufacturing techniques, process improvements, and strategic resource allocation. - What is the break-even point in relation to absorption costing?

The break-even point is where total revenue equals total costs; knowing absorption costs helps businesses determine this critical point. - Can absorption costing influence investment decisions?

Yes, understanding the full cost of production helps investors assess a company’s profitability and growth potential.

Conclusion

The Absorption Cost Calculator is an essential tool for businesses aiming to understand their production costs comprehensively. By factoring in direct labor, material, and overhead costs, organizations can determine the true cost per unit, which is vital for effective pricing strategies and profitability analysis. With a clear understanding of absorption costing, businesses can make informed decisions that contribute to their financial success and sustainability.