About Emergency Fund Calculator (Formula)

An Emergency Fund Calculator is a financial tool designed to help you calculate how much money you should set aside for emergencies. This fund ensures you are prepared to cover essential expenses in the event of a sudden job loss, medical emergency, or other unforeseen circumstances. Financial experts recommend having an emergency fund to avoid falling into debt during tough times.

Formula

The formula to calculate the emergency fund is:

Emergency Fund (EF) = Average Monthly Costs (AC) × Months of Savings (MS)

Where:

- AC is your average monthly essential expenses.

- MS is the number of months you want to be covered by your emergency fund (usually 3 to 6 months).

How to Use

- Determine your average monthly costs: List all essential expenses like rent, utilities, groceries, and healthcare.

- Decide the coverage period: Decide how many months you want to save for (typically 3 to 6 months).

- Multiply: Multiply your monthly costs by the chosen number of months.

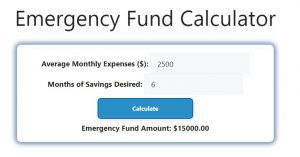

- Use the Calculator: Simply input these values into the Emergency Fund Calculator to get your savings goal.

Example

If your average monthly expenses are $2,500 and you want to save for 6 months of coverage, your emergency fund will be calculated as:

Emergency Fund (EF) = 2,500 × 6

Emergency Fund = $15,000

This means you should aim to save $15,000 for your emergency fund.

FAQs

- What is an emergency fund?

An emergency fund is a savings account used to cover unexpected expenses, like medical bills or car repairs, or to cover essential living costs if you lose your income. - How much should I save in my emergency fund?

The typical recommendation is to save 3 to 6 months’ worth of essential living expenses, but this can vary depending on your situation. - What expenses should be included in my emergency fund?

Include essential expenses such as rent/mortgage, utilities, groceries, insurance, and minimum debt payments. - How do I calculate my average monthly expenses?

Sum up all your essential living costs for a month, such as housing, food, transportation, insurance, and utilities. - Why is an emergency fund important?

An emergency fund helps you avoid debt and financial stress when unexpected expenses arise, providing a financial safety net. - Should I use my emergency fund for non-essential purchases?

No, your emergency fund should only be used for unexpected, essential expenses or income loss. - Can I build my emergency fund gradually?

Yes, you can contribute to your emergency fund over time, ideally saving a portion of your income each month. - What if I have fluctuating monthly expenses?

In that case, calculate the average of your fluctuating expenses over the last 3 to 6 months. - Where should I keep my emergency fund?

Keep your emergency fund in a high-interest savings account or a liquid investment where you can access it quickly. - What if I don’t have enough money to save for 6 months?

Start with a goal of 3 months of savings and gradually increase it over time as your financial situation allows. - Should I invest my emergency fund?

It’s best to keep your emergency fund in a liquid, low-risk account rather than investing it in volatile assets like stocks. - Can I use part of my emergency fund for planned expenses?

Your emergency fund should only be used for unforeseen emergencies, not planned or non-essential expenses. - What happens if I need to use my emergency fund?

If you need to use your emergency fund, make a plan to replenish it once your financial situation stabilizes. - Is it okay to keep my emergency fund in cash?

While it’s good to have some cash on hand, most of your emergency fund should be kept in a secure bank account to prevent loss or theft. - What if I have irregular income?

If you have irregular income, aim to save closer to 6 months of expenses to provide a larger safety net. - How often should I reassess my emergency fund goal?

Reevaluate your emergency fund goal annually or whenever your financial situation or expenses change significantly. - How can I grow my emergency fund faster?

Cut back on discretionary spending, set up automatic transfers to your savings, and use any extra income like tax refunds or bonuses to boost your fund. - Do I need an emergency fund if I have insurance?

Yes, an emergency fund is still necessary to cover deductibles, co-pays, or expenses not covered by insurance. - Can I have multiple emergency funds?

Yes, some people set up separate funds for different types of emergencies, like one for medical expenses and another for job loss. - Is it ever too late to start an emergency fund?

No, it’s never too late to start saving. Even a small emergency fund is better than none at all.

Conclusion

An Emergency Fund Calculator is a simple yet powerful tool to help you plan for the unexpected. By calculating how much you need to set aside, you can ensure that you are financially prepared for emergencies without relying on loans or credit cards. Whether you’re just starting or looking to build your savings further, having an emergency fund is a crucial step in achieving financial stability.