About CD Profit Calculator (Formula)

Investing in certificates of deposit (CDs) is a popular choice for those seeking a secure way to grow their savings. A CD Profit Calculator helps investors determine the profit generated from their CD investments, allowing for better financial planning and decision-making. Understanding how to use this calculator can provide clarity on your earnings and help you compare different investment options. In this article, we will explore the formula used in the calculation, guide you on how to use the calculator, provide an example, and address frequently asked questions related to CD profits.

Formula

The formula for calculating the profit from a certificate of deposit (CD) is as follows: CDP = SP – P, where CDP represents the CD profit, SP is the selling price of the CD at maturity, and P is the principal amount invested in the CD. This formula helps investors easily assess their earnings from the investment.

How to Use

Using the CD Profit Calculator is a straightforward process:

- Determine the Principal Amount (P): Identify the initial amount you invested in the CD.

- Identify the Selling Price (SP): This is the amount you will receive when the CD matures.

- Input Values: Enter the principal amount and the selling price into the calculator.

- Calculate Profit: Click the “Calculate” button to find the profit generated from the CD.

- Review Results: The calculator will display the profit, giving you insight into your investment’s performance.

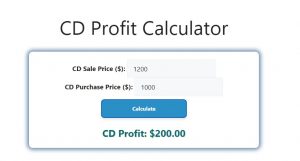

Example

Let’s consider an example where an investor wants to calculate the profit from a CD with the following values:

- Principal Amount (P): $1,000

- Selling Price (SP): $1,200

Using the formula:

CDP = SP – P

Substituting the values:

CDP = 1,200 – 1,000

CDP = $200

In this example, the profit from the CD is $200, indicating a successful investment.

FAQs

- What is a CD Profit Calculator?

A CD Profit Calculator is a tool that helps investors calculate the profit earned from their certificates of deposit. - Why is it important to calculate CD profits?

Knowing your CD profits helps in assessing investment performance and making informed financial decisions. - What does CDP stand for?

CDP stands for CD Profit, representing the earnings generated from a certificate of deposit. - What is the principal amount?

The principal amount is the initial sum of money invested in the CD. - How is the selling price determined?

The selling price is the total amount received upon the maturity of the CD, which includes interest earned. - Can I calculate profits from multiple CDs at once?

Yes, you can use the calculator for multiple CDs by calculating each one separately or aggregating results. - Are CDs risk-free investments?

CDs are generally considered low-risk investments, but it’s important to check the terms and conditions. - How often is interest paid on CDs?

Interest on CDs can be paid monthly, quarterly, annually, or at maturity, depending on the CD terms. - What happens if I withdraw my CD early?

Early withdrawal typically results in penalties, which can reduce the overall profit. - How long do I need to invest in a CD?

CDs have various terms, ranging from a few months to several years. Longer terms usually offer higher interest rates. - Can I reinvest my CD profits?

Yes, many investors choose to reinvest their profits into new CDs or other investment opportunities. - What factors influence CD interest rates?

Interest rates can be influenced by market conditions, inflation, and central bank policies. - Is the interest earned on CDs taxable?

Yes, interest earned on CDs is subject to federal income tax and may be subject to state taxes. - How can I find the best CD rates?

Compare rates from different banks and credit unions, and consider using financial websites that aggregate this information. - What should I consider before investing in a CD?

Consider the interest rate, term length, penalties for early withdrawal, and your overall financial goals. - Can I have multiple CDs with different banks?

Yes, investors often diversify their investments by opening CDs with different banks. - What is the difference between a traditional CD and a high-yield CD?

High-yield CDs typically offer higher interest rates than traditional CDs, often requiring larger minimum investments. - Can I add funds to my CD after opening it?

Most CDs do not allow additional deposits after the initial investment; however, some offer this feature. - What is the minimum investment for a CD?

Minimum investments vary by bank and can range from $500 to $10,000 or more. - How do I choose the right CD for my investment goals?

Assess your financial needs, the length of time you can leave your money untouched, and the interest rates offered.

Conclusion

The CD Profit Calculator is an invaluable tool for anyone looking to invest in certificates of deposit. By understanding the formula and utilizing the calculator, investors can effectively assess their earnings and make informed decisions about their financial future. Whether you are new to investing or an experienced investor, knowing how to calculate CD profits is essential for managing your portfolio and optimizing your investment strategy. With careful planning and analysis, you can make the most of your CD investments and achieve your financial goals.