About Reverse Paycheck Calculator (Formula)

A Reverse Paycheck Calculator is a valuable tool for individuals seeking to understand their annual salary based on their weekly earnings. This calculator simplifies the process of converting weekly pay into an annual salary, allowing you to make informed financial decisions and budget effectively. Whether you’re negotiating a salary, evaluating job offers, or planning your finances, this calculator can provide quick insights into your earnings.

Formula

The formula for calculating annual salary based on weekly pay is as follows: AS = WP * 52, where AS represents the annual salary and WP is the weekly pay. This formula allows you to project your total salary for the year by multiplying your weekly income by the number of weeks in a year.

How to Use

Using the Reverse Paycheck Calculator is straightforward:

- Input Weekly Pay (WP): Enter your total weekly earnings into the designated input field.

- Click the Calculate Button: Press the “Calculate” button to convert your weekly pay into an annual salary.

- View Your Result: The calculated annual salary will be displayed on the screen.

Example

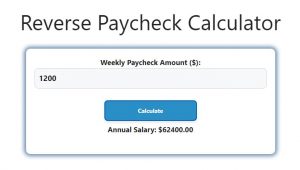

Suppose your weekly pay is $1,200.

- Input Weekly Pay: Enter $1,200 into the calculator.

- Calculation: The calculator will multiply $1,200 by 52 (the number of weeks in a year).

- Result: The annual salary would be $62,400.

FAQs

- What is a Reverse Paycheck Calculator?

A Reverse Paycheck Calculator helps determine your annual salary based on your weekly pay. - Why is this calculation important?

Understanding your annual salary can assist in budgeting, financial planning, and salary negotiations. - How does the calculator work?

It multiplies your weekly earnings by 52 to calculate your total salary for the year. - Is the calculator easy to use?

Yes, simply enter your weekly pay and click “Calculate.” - Can this calculator help when job hunting?

Absolutely! It helps you understand your annual compensation compared to job offers. - What if I work part-time?

You can still use the calculator by inputting your weekly earnings, regardless of your work hours. - Is this calculation applicable to all types of income?

Yes, as long as the income is consistent and calculated weekly, it can be used. - What if my weekly pay varies?

You may want to use an average of your weekly pay over a set period for a more accurate estimate. - Does this calculator account for taxes?

No, this calculator only provides a gross annual salary. You would need to consider taxes separately. - How can I verify the calculation?

You can manually multiply your weekly pay by 52 to check the result. - Can this tool be used for freelance income?

Yes, freelancers can input their average weekly income for this calculation. - What should I do if my pay changes?

Recalculate with your new weekly pay to see how your annual salary will change. - Is there a limit to how high my weekly pay can be?

No, the calculator can handle any numerical input within the typical range of numeric data. - What is the significance of the number 52?

There are typically 52 weeks in a year, which is why this number is used in the formula. - Will the result be accurate?

Yes, as long as you enter your weekly pay correctly, the result will be accurate. - Can I use this for budgeting purposes?

Definitely! Knowing your annual salary helps in creating a budget based on your total income. - Is this calculator only for salaries?

While primarily used for salaries, it can be applied to any income calculated on a weekly basis. - What happens if I input a negative number?

Negative numbers are not typically valid for income calculations, so ensure you input a positive figure. - Can this calculator help me understand my earnings better?

Yes, it offers clarity on how much you earn annually, allowing for better financial decisions. - Is there any additional information I should know?

Remember to factor in any deductions or benefits that might affect your net income when planning finances.

Conclusion

The Reverse Paycheck Calculator is an essential tool for anyone looking to convert their weekly pay into an annual salary. By understanding and utilizing the formula, individuals can make informed financial decisions, plan budgets effectively, and assess job offers. Whether you’re a salaried employee, a freelancer, or anyone earning a weekly income, this calculator can provide valuable insights into your financial landscape.