About Inflation Cost Calculator (Formula)

The Inflation Cost Calculator is a helpful tool to determine how inflation impacts the value of goods and services over time. Inflation refers to the rise in prices and the decrease in the purchasing power of money. This calculator helps users estimate how much more they will pay for goods and services as inflation increases, making it an essential tool for budgeting and financial planning.

Formula

The formula used to calculate the inflation cost is:

Inflation Cost (IC) = Previous Cost (PC) * Inflation Rate (IR) / 100

Where:

- Previous Cost (PC): The initial price of the good or service.

- Inflation Rate (IR): The percentage increase in prices over a certain period.

How to Use

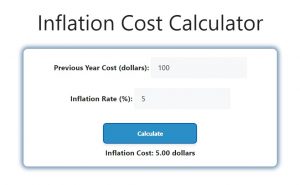

To use the Inflation Cost Calculator, follow these steps:

- Input the Previous Cost (PC): Enter the original cost of the product or service before inflation.

- Input the Inflation Rate (IR): Enter the inflation rate as a percentage.

- Calculate the Inflation Cost: The calculator will use the formula to determine the increase in cost due to inflation.

Example

Let’s say you bought a product last year for $100, and the inflation rate this year is 5%. To calculate the cost increase due to inflation:

- Previous Cost (PC): $100

- Inflation Rate (IR): 5%

Using the formula:

IC = 100 * 5 / 100

IC = $5

This means that the inflation cost is $5, making the total new price of the product $105.

FAQs

- What is inflation?

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in the purchasing power of money. - Why is it important to calculate inflation costs?

Calculating inflation costs helps individuals and businesses plan for future expenses and adjust their budgets to account for the rise in prices. - How does inflation affect my purchasing power?

As inflation increases, the amount of goods and services your money can buy decreases, meaning you will need more money to buy the same things. - What is the difference between inflation and deflation?

Inflation refers to the rise in prices, while deflation refers to a decrease in prices, leading to an increase in the purchasing power of money. - How is the inflation rate calculated?

The inflation rate is calculated by comparing the price index of goods and services over time, typically measured annually. - Can inflation vary by region or country?

Yes, inflation rates can vary by region or country due to different economic conditions, government policies, and market factors. - How does inflation affect savings?

Inflation erodes the value of savings because the money saved today will have less purchasing power in the future if inflation rises. - What is a good inflation rate?

A moderate inflation rate, typically between 2% to 3%, is considered healthy for an economy as it encourages spending and investment. - How does inflation impact long-term financial planning?

Inflation affects long-term financial planning by reducing the real value of money over time, so it’s essential to adjust investment and saving strategies to account for inflation. - Can inflation affect my salary?

Yes, inflation can erode the purchasing power of your salary if wages do not increase at the same rate as inflation. - How do central banks control inflation?

Central banks use monetary policy tools, such as adjusting interest rates and regulating money supply, to control inflation. - What is hyperinflation?

Hyperinflation is an extremely high and typically accelerating rate of inflation, which can cause the collapse of a currency and economic instability. - How does inflation affect loan payments?

Inflation can benefit borrowers because it reduces the real value of fixed loan payments, making debt easier to pay off over time. - What is core inflation?

Core inflation measures the price increase of goods and services excluding volatile items like food and energy, providing a more stable view of inflation trends. - How do businesses cope with inflation?

Businesses adjust prices, reduce costs, and may increase wages to cope with inflation while maintaining profitability. - Does inflation affect investments?

Yes, inflation can impact investments by reducing real returns, especially on fixed-income investments like bonds. - How do I protect my investments from inflation?

Investing in assets like stocks, real estate, and inflation-protected securities can help safeguard your wealth from the effects of inflation. - What role does the government play in managing inflation?

Governments manage inflation through fiscal policies, including taxation, spending, and borrowing, to regulate economic activity. - What is stagflation?

Stagflation is a situation where inflation is high, but economic growth is slow, leading to high unemployment and stagnant demand. - Can inflation be predicted?

While inflation can be forecasted based on economic indicators, it is influenced by many factors, making exact predictions difficult.

Conclusion

The Inflation Cost Calculator is a practical tool for understanding how inflation affects the cost of goods and services. By calculating the additional costs incurred due to inflation, individuals and businesses can make informed financial decisions and better prepare for future economic conditions. Understanding inflation and its effects is crucial for managing personal and business finances in an ever-changing economy.