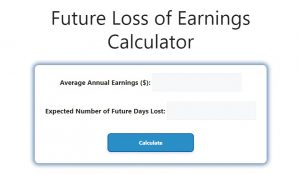

About Future Loss of Earnings Calculator (Formula)

The Future Loss of Earnings Calculator is a valuable tool for individuals who have experienced an injury or other life event that affects their ability to work. Understanding the financial implications of reduced earning capacity is crucial for making informed decisions regarding legal claims, insurance, and personal finances. This calculator estimates the potential future loss of earnings by factoring in annual income, deductions, and the number of years the loss is expected to last. This article will explore the formula used in the calculation, how to utilize the tool effectively, and answer common questions about future loss of earnings.

Formula

The formula for calculating future loss of earnings is:

Future Loss of Earnings = (Annual Income – Deductions) x Years of Loss

Where:

- Annual Income: The total income earned in a year prior to the loss.

- Deductions: Any deductions from the annual income, such as taxes or other withholdings.

- Years of Loss: The estimated number of years the individual will be unable to work.

How to Use

- Determine Annual Income: Identify your total annual income before the loss of earnings.

- Calculate Deductions: Subtract any applicable deductions from your annual income. This includes taxes, insurance, or retirement contributions.

- Estimate Years of Loss: Estimate how many years you expect to be unable to work due to your situation.

- Apply the Formula: Use the formula to calculate the potential future loss of earnings.

Example

Suppose an individual has an annual income of $50,000, with deductions totaling $10,000. If they expect to be unable to work for 5 years due to an injury, the calculation would be as follows:

- Annual Income: $50,000

- Deductions: $10,000

- Years of Loss: 5

Calculation: Future Loss of Earnings = (50,000 – 10,000) x 5

Future Loss of Earnings = 40,000 x 5 = $200,000

In this scenario, the individual would estimate a future loss of earnings of $200,000.

FAQs

- What is the Future Loss of Earnings Calculator?

It is a tool that estimates the financial impact of lost income due to injury or other life events. - Why is it important to calculate future loss of earnings?

It helps individuals understand their financial losses, which can be crucial for insurance claims or legal proceedings. - What factors should I consider when estimating my annual income?

Consider your current salary, bonuses, overtime, and any additional income sources. - What types of deductions should I include?

Include federal and state taxes, social security, health insurance premiums, and retirement contributions. - How do I estimate the number of years of loss?

Base your estimate on medical advice regarding recovery time and your potential to return to work. - Can I use this calculator for temporary loss of earnings?

Yes, the calculator can also be used to estimate temporary loss by adjusting the years of loss accordingly. - What if I have variable income?

For variable income, consider averaging your earnings over the past few years to determine a reasonable estimate. - Is this calculator applicable to self-employed individuals?

Yes, self-employed individuals can use the same method to estimate their future loss of earnings. - How accurate is this calculator?

The calculator provides an estimate; actual losses may vary based on numerous factors. - Can this calculator help in legal cases?

Yes, it can serve as a basis for calculating damages in personal injury or wrongful termination cases. - What if my income changes in the future?

You may need to adjust your calculations if your income increases or decreases during the period of loss. - How does inflation affect future loss of earnings?

Consider inflation when calculating future losses, as it can reduce the purchasing power of your earnings over time. - Can I include benefits in my calculation?

Yes, consider benefits such as health insurance, retirement contributions, and bonuses in your calculations. - What is the best way to document my income?

Use tax returns, pay stubs, and financial statements to document your income and deductions. - Do I need professional assistance for this calculation?

While the calculator is straightforward, consulting with a financial advisor or attorney may provide additional insight. - What if I’m unable to return to work at all?

If you cannot return to work, consider estimating your potential earnings for a longer period or until retirement. - Is there a limit to how many years I can estimate?

There’s no strict limit, but it’s important to base your estimate on realistic scenarios. - How do I handle loss of earnings from multiple sources?

Calculate the loss from each source individually and sum the totals for a comprehensive estimate. - What should I do if I have additional expenses due to my situation?

Document all additional expenses, as they may be included in any financial claim related to your loss. - How often should I reevaluate my future loss of earnings?

Reevaluate periodically or after significant changes in your employment status or health.

Conclusion

The Future Loss of Earnings Calculator serves as a vital tool for assessing the financial impact of lost income due to various life events. By understanding how to accurately calculate future losses, individuals can better prepare for financial challenges and make informed decisions regarding legal actions and insurance claims. Whether facing a temporary or permanent loss of income, this calculator helps illuminate the potential financial road ahead, enabling users to navigate their situations with clarity and confidence.