About Relative Price Calculator (Formula)

A Relative Price Calculator is a valuable tool for consumers and investors who want to compare the current price of an item or asset to its historical or reference price. Understanding relative prices can help you gauge market trends, make informed purchasing decisions, and analyze investment opportunities. In this article, we will explore the formula for calculating relative prices, how to use the calculator, provide a practical example, and answer frequently asked questions to enhance your understanding.

Formula

The formula for calculating relative price is:

Relative Price = Current Price / Reference Price

Where:

- Current Price is the price of the item or asset at the present time.

- Reference Price is the price of the item or asset at a previous time or a benchmark price for comparison.

How to Use

- Determine the Current Price: Find the current market price of the product or asset you want to evaluate.

- Identify the Reference Price: Obtain the reference price, which could be the historical price, average price, or a standard price for comparison.

- Apply the Formula: Use the formula to calculate the relative price by dividing the current price by the reference price.

- Analyze the Result: The result will help you understand how the current price compares to the reference price, indicating whether it is relatively high or low.

Example

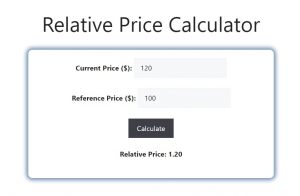

Let’s say you want to calculate the relative price of a stock that currently trades at $120, and its reference price (average price over the last year) was $100.

Step 1: Identify the Current Price

Current Price = $120

Step 2: Determine the Reference Price

Reference Price = $100

Step 3: Apply the Formula

Relative Price = Current Price / Reference Price

Relative Price = $120 / $100

Step 4: Calculate

Relative Price = 1.2

In this example, the relative price of 1.2 indicates that the current price is 20% higher than the reference price.

FAQs

- What is a relative price?

Relative price measures the current price of an item compared to a reference price, providing context for its valuation. - Why is the relative price important?

It helps consumers and investors assess whether a price is fair, inflated, or undervalued in the market. - How do I choose a reference price?

A reference price can be historical prices, average market prices, or prices of similar products. - What if the reference price is zero?

If the reference price is zero, the calculation cannot be performed, as division by zero is undefined. - Can relative price be used for services?

Yes, the relative price calculator can be applied to both products and services to evaluate their pricing. - Is a relative price greater than 1 always bad?

Not necessarily; a relative price greater than 1 indicates the current price is higher than the reference price, which may be justified based on market conditions. - How can I use relative price in investment decisions?

Investors use relative prices to determine whether to buy, sell, or hold assets based on their current valuation compared to historical benchmarks. - Can I use this calculator for inflation adjustments?

Yes, the relative price can help adjust for inflation by comparing current prices to inflation-adjusted historical prices. - How often should I recalculate relative prices?

Recalculating relative prices periodically can help you stay informed about market trends and price fluctuations. - Can relative price help in budgeting?

Yes, understanding relative prices can aid in budgeting by providing insights into whether current expenditures are reasonable compared to historical spending. - What factors can affect relative prices?

Market demand, supply chain issues, seasonal trends, and economic conditions can all influence relative prices. - Is the relative price calculation the same for all assets?

Yes, the formula remains the same, but the interpretation may vary depending on the asset type and market context. - What industries commonly use relative pricing?

Retail, real estate, and financial services are some industries that frequently use relative pricing for decision-making. - Can I use relative price for comparisons across different products?

Relative price comparisons are most accurate when comparing similar items; comparing different products may require additional analysis. - How can I visualize relative price changes over time?

Using graphs or charts to plot relative prices over time can help visualize trends and fluctuations. - What is the difference between relative price and absolute price?

Relative price provides context by comparing prices, while absolute price is the actual price without any comparison. - Can I use this calculator for international pricing?

Yes, but consider currency exchange rates when calculating relative prices for products priced in different currencies. - What if my current price is lower than the reference price?

A relative price below 1 indicates that the current price is lower than the reference price, which may present a buying opportunity. - How can I find the reference price for a product?

Researching market reports, historical data, and pricing databases can help you determine an appropriate reference price. - Is there software that can automate relative price calculations?

Yes, many financial analysis tools and spreadsheet software can automate relative price calculations for convenience.

Conclusion

The Relative Price Calculator is an essential tool for anyone looking to make informed financial decisions, whether in purchasing products or evaluating investment opportunities. By understanding how to calculate and interpret relative prices, you can gain valuable insights into market conditions and pricing trends. Regularly using this calculator will enhance your ability to make strategic decisions based on accurate price comparisons.