About Borrowing Cost Calculator (Formula)

The Borrowing Cost Calculator is a valuable financial tool designed to help individuals and businesses estimate the total cost of borrowing money. Understanding borrowing costs is essential for effective financial planning, allowing borrowers to make informed decisions about loans and credit. This calculator takes into account the total amount borrowed, the annual interest rate, and the length of borrowing, providing a clear picture of the financial obligations associated with a loan.

Formula

The formula for calculating borrowing cost is:

Borrowing Cost = Total Amount Borrowed * Annual Interest Rate / 100 * Length of Borrowing

Where:

- Total Amount Borrowed is the principal amount of the loan.

- Annual Interest Rate is the percentage of interest charged on the borrowed amount each year.

- Length of Borrowing refers to the duration of the loan, typically measured in years.

How to Use

- Determine the Total Amount Borrowed: Identify the principal amount you wish to borrow.

- Identify the Annual Interest Rate: Obtain the interest rate that will be applied to your loan, usually provided by the lender.

- Specify the Length of Borrowing: Decide on the duration for which you will be borrowing the money, expressed in years.

- Input Values into the Formula: Substitute the values into the borrowing cost formula.

- Perform the Calculation: Multiply the total amount borrowed by the annual interest rate (as a decimal) and then by the length of borrowing to calculate the total borrowing cost.

Example

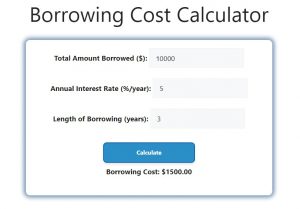

Let’s consider an example to illustrate how to calculate borrowing costs.

- Given Data:

- Total Amount Borrowed = $10,000

- Annual Interest Rate = 5%

- Length of Borrowing = 3 years

Step 1: Apply the Formula

Borrowing Cost = Total Amount Borrowed * Annual Interest Rate / 100 * Length of Borrowing

= $10,000 * 5 / 100 * 3

Step 2: Complete the Calculation

Borrowing Cost = $10,000 * 0.05 * 3

Borrowing Cost = $1,500

In this example, the total borrowing cost for the loan would be $1,500 over three years.

FAQs

- What is a borrowing cost?

Borrowing cost refers to the total expense incurred when borrowing money, including interest and any associated fees. - How is the annual interest rate defined?

The annual interest rate is the percentage charged on the total amount borrowed over one year. - What is the difference between fixed and variable interest rates?

A fixed interest rate remains constant throughout the loan term, while a variable interest rate can change based on market conditions. - Are there any additional costs associated with borrowing?

Yes, additional costs may include loan origination fees, processing fees, and insurance costs, which should be factored into the total borrowing cost. - Can I use this calculator for different types of loans?

Yes, the calculator can be applied to various loan types, including personal loans, mortgages, and business loans. - What happens if I pay off the loan early?

Paying off a loan early may reduce the total borrowing cost, but some lenders may impose prepayment penalties. - Is the borrowing cost the same as the total loan amount?

No, the borrowing cost is separate from the loan amount; it refers specifically to the interest and fees associated with the loan. - How can I lower my borrowing costs?

You can lower borrowing costs by improving your credit score, shopping around for better interest rates, and negotiating loan terms. - What is the impact of loan term length on borrowing costs?

Longer loan terms typically result in higher total borrowing costs due to accumulated interest over time. - Can this calculator help me compare loans?

Yes, by calculating borrowing costs for different loans, you can easily compare which option is more cost-effective. - What should I do if I don’t understand the interest rate?

If you don’t understand the interest rate, ask your lender for clarification or seek advice from a financial advisor. - How is borrowing cost different from total cost of a loan?

Borrowing cost refers specifically to interest, while total cost includes both interest and any fees associated with the loan. - Do all lenders charge the same interest rates?

No, interest rates can vary significantly among lenders based on creditworthiness, loan type, and market conditions. - What is a loan amortization schedule?

A loan amortization schedule details each payment over the loan term, showing the breakdown of principal and interest. - Are borrowing costs tax-deductible?

In some cases, borrowing costs for certain loans, such as mortgages, may be tax-deductible. Consult a tax professional for advice. - What is a loan origination fee?

A loan origination fee is a charge by the lender for processing a new loan application, typically expressed as a percentage of the loan amount. - How do I know if a loan is worth the borrowing cost?

Evaluate your financial situation, loan purpose, and potential return on investment to determine if the borrowing cost is justified. - What is the difference between APR and interest rate?

The APR (Annual Percentage Rate) includes both the interest rate and any additional fees, providing a more comprehensive view of borrowing costs. - Can I refinance to reduce my borrowing costs?

Refinancing may help reduce borrowing costs if you can secure a lower interest rate or better loan terms. - Where can I find reliable interest rates?

You can find reliable interest rates from banks, credit unions, and online financial resources. Always compare multiple sources.

Conclusion

The Borrowing Cost Calculator serves as a vital resource for anyone considering taking out a loan. By accurately estimating borrowing costs, individuals and businesses can make more informed financial decisions and budget effectively. Understanding how borrowing works is crucial in today’s financial landscape, where even small differences in interest rates can lead to significant cost variations over time. With this knowledge, borrowers can navigate the lending process with confidence and ensure they choose the best financing options for their needs.