About Return on Bond Calculator (Formula)

The Return on Bond Calculator is a valuable financial tool designed for investors looking to evaluate the performance of their bond investments. By calculating the return on investment (ROI) for bonds, investors can assess the effectiveness of their financial strategies and make informed decisions regarding their portfolios. Understanding the return on bonds is crucial, as it helps determine the potential yield and overall financial health of an investment.

Formula

The formula for calculating Return on Bond is:

Return on Bond (ROB) = ((Current Value – Purchase Price) / Purchase Price) * 100

Where:

- ROB is the percentage return on the bond.

- Current Value is the current market value of the bond.

- Purchase Price is the initial price paid for the bond.

How to Use

To use the Return on Bond Calculator, follow these steps:

- Determine the Purchase Price: Identify the price at which you initially purchased the bond.

- Find the Current Value: Determine the current market value of the bond. This information can usually be found on financial news websites or through your brokerage account.

- Insert Values into the Formula: Use the formula:

Return on Bond (ROB) = ((Current Value – Purchase Price) / Purchase Price) * 100. - Calculate the Return: Perform the calculation to find the percentage return on your bond investment.

- Analyze Your Results: Evaluate whether the return meets your investment goals and consider whether to hold or sell the bond based on its performance.

Example

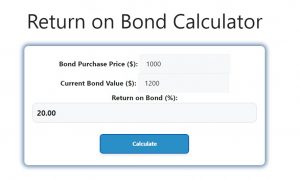

Let’s consider an example to illustrate how the Return on Bond Calculator works.

- Purchase Price: $1,000

- Current Value: $1,200

Using the formula:

ROB = ((1,200 – 1,000) / 1,000) * 100

ROB = (200 / 1,000) * 100

ROB = 20%

In this example, the return on the bond investment would be 20%.

FAQs

- What is a bond?

A bond is a fixed-income security that represents a loan made by an investor to a borrower, typically a corporation or government. - Why is the return on bond important?

The return on bond helps investors understand how profitable their bond investments are and assists in comparing different investment options. - What factors can affect the current value of a bond?

Factors include interest rates, credit ratings, inflation, and overall market conditions. - How often should I calculate the return on my bonds?

It’s advisable to calculate the return periodically or whenever significant changes occur in market conditions or your investment strategy. - Can I use this calculator for municipal bonds?

Yes, the Return on Bond Calculator can be used for any type of bond, including municipal bonds, corporate bonds, and government bonds. - What is the difference between yield and return?

Yield typically refers to the income generated by the bond (interest payments), while return encompasses the overall profit or loss from the investment. - How do changes in interest rates affect bond values?

Generally, when interest rates rise, existing bond prices fall, and vice versa, impacting their current market value and return. - What should I do if my bond’s return is negative?

Assess the reasons for the negative return, such as market conditions or changes in credit ratings, and decide whether to hold, sell, or buy more of the bond. - Is the Return on Bond Calculator suitable for new investors?

Yes, it’s a user-friendly tool that helps new investors understand the performance of their bond investments. - What is the typical timeframe for bond investments?

Bonds can have various maturities, ranging from a few months to several decades, depending on the type of bond and the issuer. - How can I improve my bond returns?

Consider diversifying your bond portfolio, investing in higher-yield bonds, or monitoring interest rate trends to make informed decisions. - What is a bond rating?

A bond rating is an evaluation of the creditworthiness of a bond issuer, indicating the risk associated with the bond. - What are some common types of bonds?

Common types include government bonds, municipal bonds, corporate bonds, and high-yield bonds. - Can I lose money on bonds?

Yes, bond investments can result in losses if interest rates rise, the issuer defaults, or the bonds are sold at a lower price than their purchase price. - What is the significance of the bond’s maturity date?

The maturity date indicates when the bond will pay back its principal amount, impacting its price sensitivity to interest rate changes. - Do bonds pay interest?

Yes, bonds typically pay interest, known as coupon payments, at regular intervals until maturity. - What should I consider before buying a bond?

Consider factors such as the bond’s credit rating, yield, maturity, and the overall economic environment. - How does inflation affect bond returns?

Inflation can erode the purchasing power of interest payments, potentially reducing the real return on bond investments. - Are bonds risk-free investments?

While government bonds are often considered low-risk, all bonds carry some level of risk, including credit risk and interest rate risk. - What resources can help me find bond investments?

Financial news websites, brokerage platforms, and investment advisors can provide valuable information on available bond options.

Conclusion

The Return on Bond Calculator is an essential tool for investors aiming to evaluate their bond investments’ performance. By using the formula Return on Bond (ROB) = ((Current Value – Purchase Price) / Purchase Price) * 100, investors can easily calculate the percentage return on their bonds. This understanding enables better decision-making, allowing investors to optimize their portfolios and achieve their financial goals effectively.