About Average Daily Float Calculator (Formula)

The Average Daily Float (ADF) Calculator is a valuable financial tool used to assess the average amount of cash available in an account on a daily basis. By calculating the ADF, individuals and businesses can gain insights into their cash flow management, helping them make informed financial decisions. This calculator considers the value of checks written and the total number of days over which these transactions occur, allowing users to evaluate their liquidity and plan accordingly.

Formula

The formula for calculating Average Daily Float (ADF) is:

Average Daily Float (ADF) = Value of Checks / Total Days

Where:

- Value of Checks refers to the total dollar amount of checks issued.

- Total Days is the time period over which the checks are analyzed.

How to Use

Using the Average Daily Float Calculator is simple and straightforward. Follow these steps:

- Gather Your Data: Collect the total value of checks issued during the specified time period.

- Determine the Time Frame: Decide on the number of days over which you want to calculate the ADF.

- Input Values: Enter the total value of checks and the total days into the calculator.

- Calculate ADF: Click the calculate button to obtain your Average Daily Float.

Example

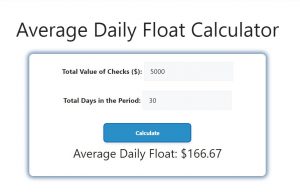

To illustrate how to use the Average Daily Float Calculator, consider the following example:

- Input Values:

- Value of Checks = $5,000

- Total Days = 30

- Apply the Formula:

- Average Daily Float (ADF) = $5,000 / 30

- Average Daily Float (ADF) = $166.67

In this example, the Average Daily Float is $166.67, indicating the average amount of cash available daily based on the checks issued.

FAQs

- What is Average Daily Float (ADF)?

ADF is a measure of the average amount of cash available in an account on a daily basis, calculated based on the value of checks issued over a specified period. - Why is ADF important for businesses?

Understanding ADF helps businesses manage their cash flow effectively, ensuring they have sufficient funds to cover expenses. - Can ADF be negative?

No, ADF cannot be negative; it represents the average cash available, which is a non-negative value. - How often should I calculate ADF?

It depends on your financial activity; regular calculations can help monitor cash flow trends. - What types of checks are considered in the ADF calculation?

Any checks issued from the account being analyzed can be included, such as payments to suppliers, salaries, and other expenses. - Does ADF consider bank processing times?

ADF does not account for processing times; it only considers the value of checks issued and the total days. - Can I use ADF to compare different time periods?

Yes, comparing ADF across different periods can provide insights into changes in cash flow management. - What happens if I don’t have the exact number of days?

You can estimate the total days based on the period in which the checks were issued, but accuracy is preferable. - Is ADF useful for personal finance?

Yes, individuals can use ADF to understand their spending habits and manage personal cash flow. - Does the ADF calculation change for different currencies?

The calculation remains the same; just ensure all values are in the same currency. - Can ADF help in budgeting?

Yes, ADF can provide insights into how much cash is available on average, aiding in effective budgeting. - What other factors should I consider with ADF?

Consider other financial metrics, such as expenses and revenues, to get a comprehensive view of cash flow. - Is there a specific range for a healthy ADF?

A healthy ADF varies by industry and business size; comparing with industry standards can provide guidance. - How do checks impact cash flow?

Issued checks reduce available cash until they are cleared, affecting cash flow management. - Can I calculate ADF for multiple accounts?

Yes, you can calculate ADF for each account separately for better cash flow analysis. - Are there tools available for calculating ADF?

Many financial software applications and online calculators can assist in calculating ADF easily. - What is the difference between ADF and average account balance?

ADF focuses specifically on checks issued, while the average account balance considers all transactions. - How can I improve my ADF?

Effective cash management practices, such as timely invoicing and expense control, can help improve ADF. - Is ADF affected by outstanding checks?

ADF only considers checks that have been issued, not outstanding ones, as they may not yet impact cash flow. - Can ADF be used for non-check transactions?

ADF is specifically for checks; however, similar calculations can be made for other transaction types using different metrics.

Conclusion

The Average Daily Float Calculator is an essential tool for individuals and businesses seeking to manage their cash flow effectively. By providing a clear understanding of the average amount of cash available based on checks issued, it aids in financial decision-making and planning. Regular calculations of ADF can lead to better cash management practices, ensuring that funds are available when needed and helping to maintain financial stability. Whether for personal finance or business management, the Average Daily Float Calculator serves as a reliable resource for informed financial strategies.