About Target Price Calculator (Formula)

The Target Price Calculator is an essential tool for businesses and individuals looking to set competitive selling prices for their products or services. By calculating the target price based on item costs and desired profit margins, sellers can ensure they cover expenses while achieving their financial goals. This calculator simplifies the pricing process, enabling users to make informed decisions that balance profitability and market competitiveness.

Formula

The formula for calculating the target price is:

Target Price = Item Cost / (1 – (Target Margin / 100))

Where:

- Target Price represents the selling price you need to set to achieve your desired margin.

- Item Cost is the total cost of producing or purchasing the item.

- Target Margin is the desired profit margin expressed as a percentage.

How to Use

Using the Target Price Calculator is simple and involves the following steps:

- Determine the Item Cost: Identify the total cost associated with the item you wish to sell, including production, materials, labor, and overhead expenses.

- Decide on Your Target Margin: Determine the profit margin you want to achieve, expressed as a percentage of the selling price.

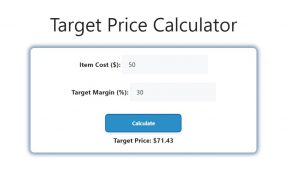

- Input the Values: Enter the item cost and the target margin into the respective fields of the calculator.

- Calculate: Click the “Calculate” button to find the target price.

- Review the Result: The calculated target price indicates the minimum price you should charge to achieve your desired profit margin.

Example

Let’s say you have the following information:

- Item Cost: $50

- Target Margin: 30%

Using the formula:

Target Price = Item Cost / (1 – (Target Margin / 100))

Target Price = $50 / (1 – (30 / 100))

Target Price = $50 / (1 – 0.30)

Target Price = $50 / 0.70

Target Price = $71.43

In this example, the target price to achieve a 30% profit margin on an item that costs $50 is $71.43.

FAQs

- What is a Target Price Calculator?

- A Target Price Calculator helps determine the selling price of an item based on its cost and the desired profit margin.

- Why is it important to calculate a target price?

- Calculating a target price ensures that businesses cover their costs while achieving desired profitability.

- How does the target margin affect the target price?

- A higher target margin increases the target price, while a lower margin decreases it, affecting overall pricing strategy.

- Can I use this calculator for any product?

- Yes, the Target Price Calculator can be used for any product or service as long as you have the item cost and desired margin.

- What if my item costs change?

- If your item costs change, you should recalculate the target price to reflect the new costs and maintain profitability.

- Is this calculator suitable for services?

- Yes, the calculator can also be applied to service-based businesses by inputting the total service cost.

- How do I determine my desired target margin?

- Your desired margin can be based on industry standards, competitive pricing, or specific business goals.

- What happens if I set the target price too low?

- Setting the target price too low may result in losses, failing to cover costs or achieve the desired profit margin.

- Can I adjust my target margin after calculating the target price?

- Yes, you can adjust the target margin at any time and recalculate the target price accordingly.

- How can I ensure my target price is competitive?

- Research your competitors’ pricing, market trends, and customer willingness to pay to set a competitive target price.

- What is the difference between target price and retail price?

- The target price is the minimum price needed to achieve a desired margin, while the retail price can vary based on market factors.

- Should I consider taxes when calculating the target price?

- Yes, if applicable, you should consider taxes as they can affect the final selling price and profitability.

- Can I use the calculator for bulk pricing?

- Yes, you can adjust the item cost for bulk orders to determine an appropriate target price.

- Is there a specific target margin percentage to aim for?

- Target margin percentages vary by industry, but a common range is between 20% to 50%.

- How often should I recalculate my target prices?

- It’s advisable to recalculate target prices whenever costs or market conditions change significantly.

- Can this calculator help with pricing strategies?

- Yes, understanding target prices can aid in developing effective pricing strategies that align with business objectives.

- What should I do if my target price is above market rates?

- If your target price is above market rates, consider adjusting your target margin or improving the value proposition of your product.

- Can I use the calculator for new product launches?

- Yes, the calculator is particularly useful for new product launches to ensure proper pricing from the outset.

- How can I track my pricing success?

- Monitor sales performance, customer feedback, and market trends to assess the effectiveness of your pricing strategy.

- What resources can help me set competitive target margins?

- Industry reports, competitor analysis, and market research can provide valuable insights into setting competitive margins.

Conclusion

The Target Price Calculator is a valuable tool for anyone involved in pricing products or services. By accurately calculating the target price based on item costs and desired profit margins, businesses can ensure they achieve their financial goals while remaining competitive in the market. Regularly assessing and adjusting target prices will help maintain profitability and adapt to changing market conditions, ultimately leading to long-term business success.