About Shadow Price Calculator (Formula)

The concept of shadow pricing is crucial in the fields of economics and operations research. A shadow price represents the implicit value of an additional unit of a resource or constraint in an optimization problem. It helps decision-makers assess how much they could benefit from relaxing a constraint or increasing resource availability. By using the Shadow Price Calculator, businesses and organizations can make informed decisions that enhance resource allocation efficiency and optimize outcomes. This article provides an overview of the formula, usage, and FAQs about the Shadow Price Calculator.

Formula

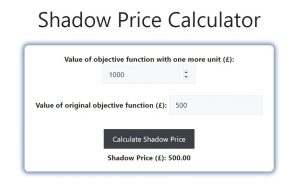

The formula for calculating Shadow Price is:

Shadow Price = Value of objective function with one more unit (£) – Value of original objective function (£)

In this formula:

- The “Value of objective function with one more unit” refers to the total benefit or value when one additional unit of a constrained resource is added.

- The “Value of original objective function” is the total benefit or value without the additional unit.

How to Use

Using the Shadow Price Calculator involves the following steps:

- Identify the Objective Function: Determine the objective function of your optimization problem, which is typically the goal you are trying to achieve, such as maximizing profit or minimizing costs.

- Calculate the Original Value: Compute the value of the objective function with the current constraints and resource levels.

- Assess the Impact of Additional Resource: Evaluate how the objective function would change if you had one more unit of the constrained resource. This often requires re-evaluating your optimization model.

- Apply the Shadow Price Formula: Subtract the value of the original objective function from the value of the objective function with the additional resource to find the shadow price.

- Analyze the Result: The shadow price indicates the potential benefit of increasing the resource by one unit. A positive shadow price suggests that increasing the resource would improve the objective, while a zero or negative value indicates that additional resources would not yield further benefits.

Example

Let’s consider an example to demonstrate how to use the Shadow Price Calculator:

- Objective Function: Suppose a company aims to maximize its profit from production.

- Original Value: After optimizing its production with limited resources, the company’s profit is £10,000.

- Additional Resource: If the company could produce one more unit of a constrained resource (e.g., raw materials), the profit would increase to £10,500.

- Apply the Formula: Shadow Price = £10,500 (value with one more unit) – £10,000 (original value)

Shadow Price = £500

In this example, the shadow price of £500 indicates that each additional unit of the constrained resource could potentially increase profit by £500.

FAQs

- What is a shadow price?

A shadow price represents the estimated value of an additional unit of a constrained resource in an optimization problem. - Why is shadow pricing important?

Shadow pricing helps organizations understand the value of resources and make informed decisions regarding resource allocation and optimization. - How do I calculate the original objective function value?

The original objective function value is calculated based on the current constraints and resource levels within your optimization model. - What does a positive shadow price indicate?

A positive shadow price indicates that adding more of the constrained resource would lead to an increase in the objective function value (e.g., profit). - What does a zero shadow price mean?

A zero shadow price suggests that increasing the constrained resource would not have any impact on the objective function value. - Can shadow prices be negative?

Yes, a negative shadow price indicates that increasing the resource could decrease the objective function value, suggesting over-allocation or inefficiency. - How do shadow prices relate to opportunity cost?

Shadow prices reflect the opportunity cost of not utilizing additional resources, indicating what could be gained by increasing resource availability. - Can I use shadow pricing in non-profit sectors?

Yes, shadow pricing can be applied in non-profit sectors to evaluate the impact of resource constraints on achieving organizational goals. - Is shadow pricing applicable to all optimization problems?

While it is most commonly used in linear programming, shadow pricing can be applied to various optimization problems across different fields. - How often should I calculate shadow prices?

It’s advisable to calculate shadow prices whenever resource availability changes or when evaluating new projects to inform decision-making. - What tools can I use to calculate shadow prices?

Various software tools, including Excel, optimization software, and linear programming solvers, can be used to calculate shadow prices effectively. - Can shadow prices change over time?

Yes, shadow prices may change as resource availability, market conditions, and production technologies evolve. - What is the difference between shadow price and market price?

The shadow price reflects the true economic value of a resource in an optimization context, while market price is based on supply and demand. - Can I use shadow pricing for environmental resources?

Yes, shadow pricing can be applied to environmental resources to assess their value and the impact of resource constraints on sustainability. - Do all constraints have shadow prices?

Not all constraints will have meaningful shadow prices; only those that limit the objective function will exhibit non-zero shadow prices. - How does sensitivity analysis relate to shadow pricing?

Sensitivity analysis helps assess how changes in constraints affect shadow prices, providing insights into resource allocation decisions. - Can shadow prices guide investment decisions?

Yes, shadow prices can inform investment decisions by highlighting resources that yield significant returns if increased. - What industries benefit from using shadow prices?

Industries such as manufacturing, agriculture, and finance can benefit from shadow pricing to enhance resource management and optimize outputs. - Can I use shadow prices for personal finance decisions?

While typically used in business contexts, the principles of shadow pricing can inform personal finance decisions, such as budgeting for investments. - Is there a limit to how many units I can assess with shadow pricing?

Shadow pricing is most effective for small incremental changes; assessing large increases may require a different analysis approach.

Conclusion

The Shadow Price Calculator is a powerful tool that provides valuable insights into resource allocation and optimization. By understanding shadow prices, decision-makers can evaluate the potential benefits of increasing constrained resources, leading to improved efficiency and profitability. Utilizing shadow prices enhances strategic planning and helps organizations make informed choices in resource management, ultimately contributing to their success and sustainability.